2024 Federal Personal Exemption. Federal individual income tax brackets, january 23, 2024 standard deduction, and personal exemption: Whether to take the standard deduction or itemize your deductions is an important decision you'll make when preparing your federal income tax.

The new financial years starts from april 1. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

Standard Deduction 2024 Over 65.

The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

Last Updated 19 March 2024.

What is the standard deduction?

As Of 2024, The Basic Personal Amount In Canada Is Set At $ 15,705.00.

Images References :

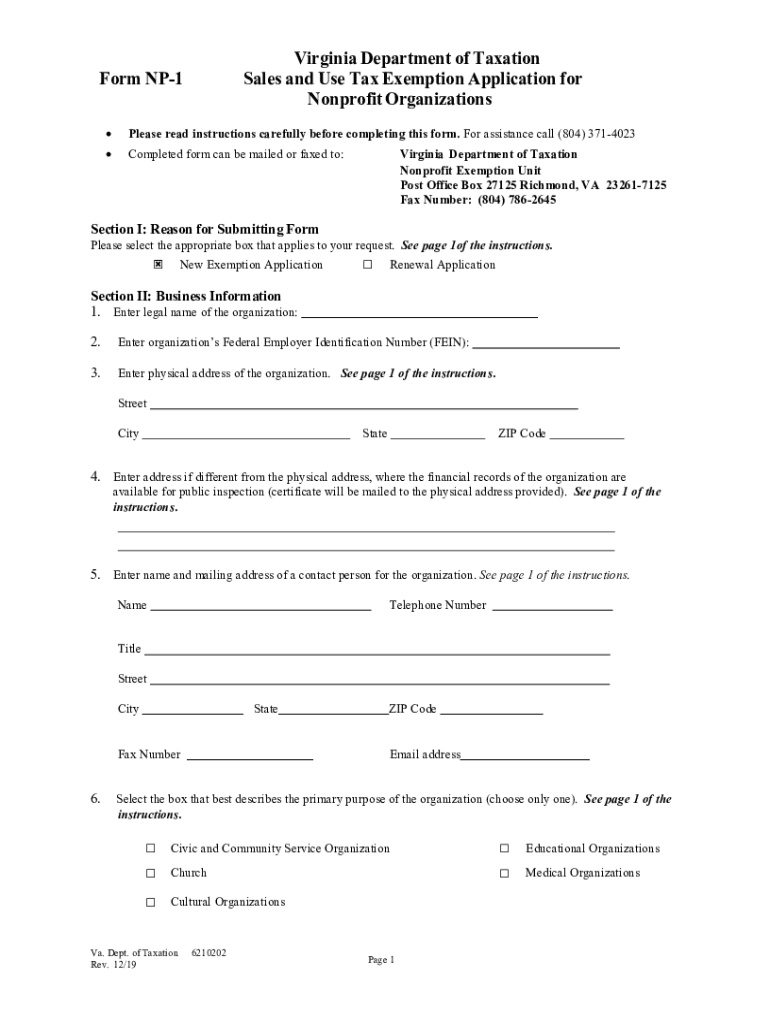

Source: www.dochub.com

Source: www.dochub.com

Tax exemption form Fill out & sign online DocHub, New year, new tax measures — what to expect in 2024. The standard deduction is a flat dollar amount set by the irs based on your filing status.

Source: www.dochub.com

Source: www.dochub.com

Va tax exemption form Fill out & sign online DocHub, As your income goes up, the. Trustpilot “excellent” top rated by forbes advisor.

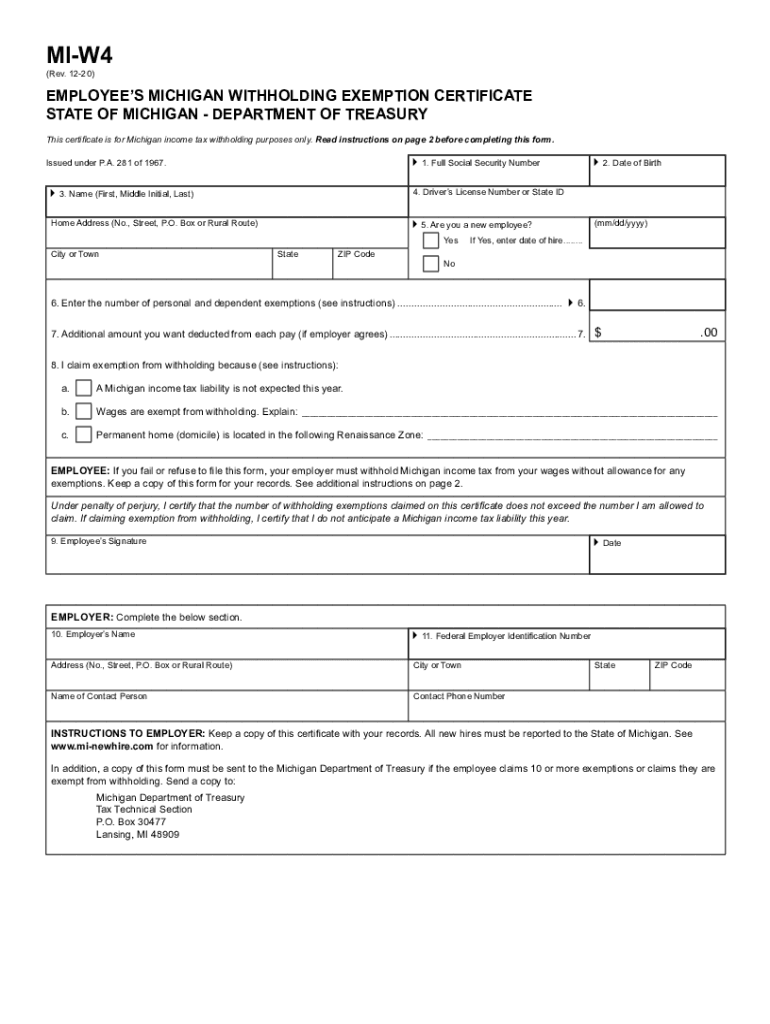

Source: www.signnow.com

Source: www.signnow.com

Michigan Sales and Use Tax Certificate of Exemption 20182024 Form, Effective march 6, 2024, and applicable to tax years beginning after december 31,. Taxpayers 65 and older and those who are blind can claim an additional standard.

Source: www.dochub.com

Source: www.dochub.com

Vaccine medical exemption form Fill out & sign online DocHub, The personal exemption for 2024 remains at $0 (eliminating the personal exemption was part of the tax cuts and jobs act of 2017 (tcja). 4, 2024 — tax credits and deductions change the amount of a person’s tax bill or refund.

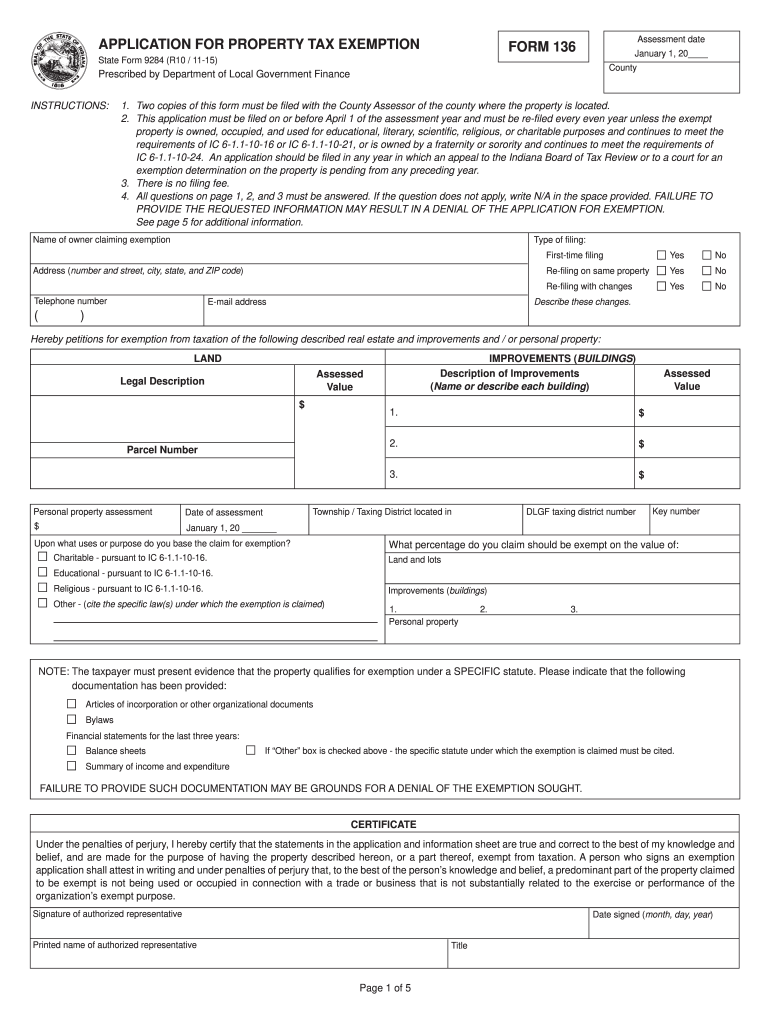

Source: form-136.pdffiller.com

Source: form-136.pdffiller.com

20152024 IN State Form 9284 Fill Online, Printable, Fillable, Blank, 4, 2024 — tax credits and deductions change the amount of a person’s tax bill or refund. Standard deduction and personal exemption.

2023 Tax Rates Hot Sex Picture, It is important to know the correct income tax rules for every. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

Source: religionnews.com

Source: religionnews.com

See which states have religious exemptions in their stayathome orders, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). As your income goes up, the.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, The personal exemption for 2024 remains at $0 (eliminating the personal exemption was part of the tax cuts and jobs act of 2017 (tcja). Effective march 6, 2024, and applicable to tax years beginning after december 31,.

Source: imagesee.biz

Source: imagesee.biz

Tabla De Isr 2023 Pdf W4 Fillable 2022 Tax IMAGESEE, Taxpayers 65 and older and those who are blind can claim an additional standard. Personal exemptions used to decrease your taxable income before you.

Source: www.signnow.com

Source: www.signnow.com

Mi W4 20202024 Form Fill Out and Sign Printable PDF Template, For 2023 (tax returns typically filed in april 2024), the standard deduction amounts are $13,850 for single and for those who are married, filing separately; The personal exemption for 2024 remains at $0 (eliminating the personal exemption was part of the tax cuts and jobs act of 2017 (tcja).

Standard Deduction 2024 Over 65.

Child and dependent care credit increases (wisconsin act 101):

It Is Important To Know The Correct Income Tax Rules For Every.

Effective march 6, 2024, and applicable to tax years beginning after december 31,.