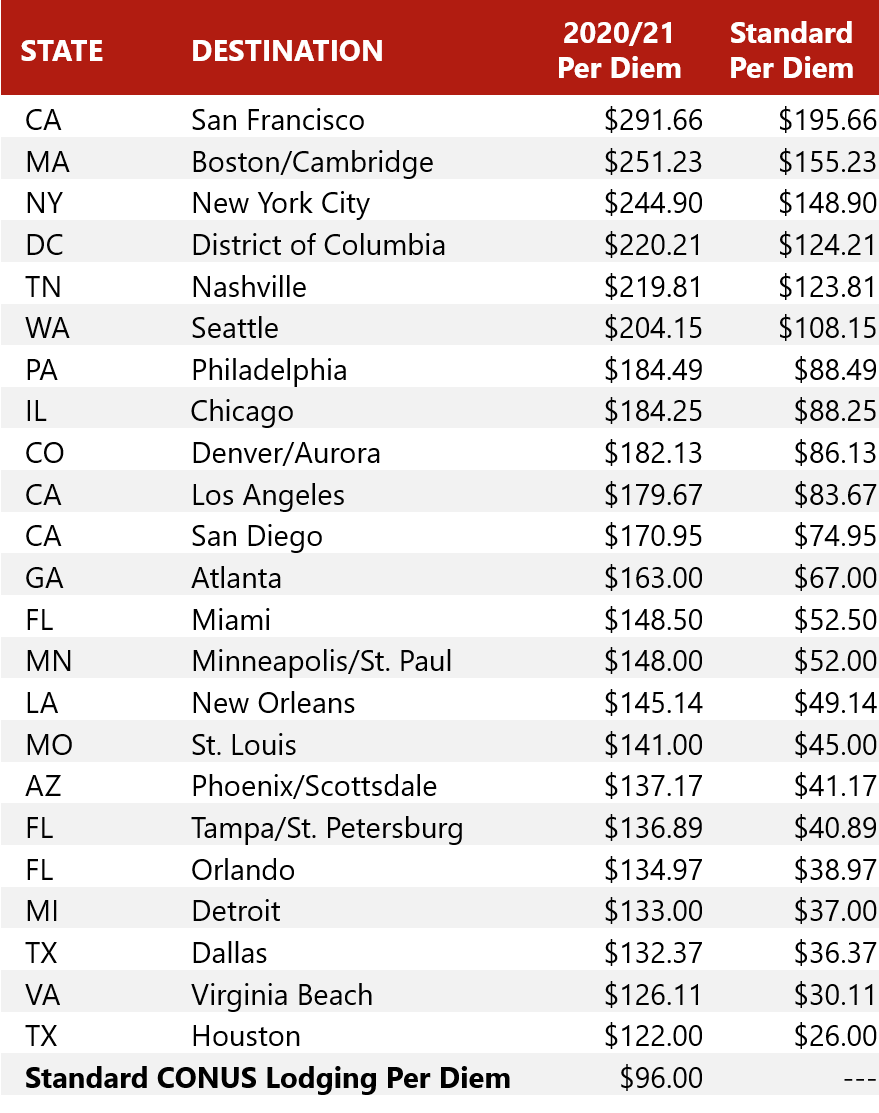

Ca State Mileage Rate 2024. Learn how the irs rate and other rules apply in the golden state. Use this table to find the following information for federal employee travel:

What is the california mileage reimbursement rate for 2023? Use this table to find the following information for federal employee travel:

Such Rates Are Subject To Open Market Rates Quoted At Time Of Actual Car Rental.

What is the california mileage reimbursement rate for 2023?

Meals &Amp; Incidentals (M&Amp;Ie) Rates And Breakdown.

Especially if they regularly drive long distances and spend money on fuel.

Ca State Mileage Rate 2024 Images References :

Source: vitoriawadara.pages.dev

Source: vitoriawadara.pages.dev

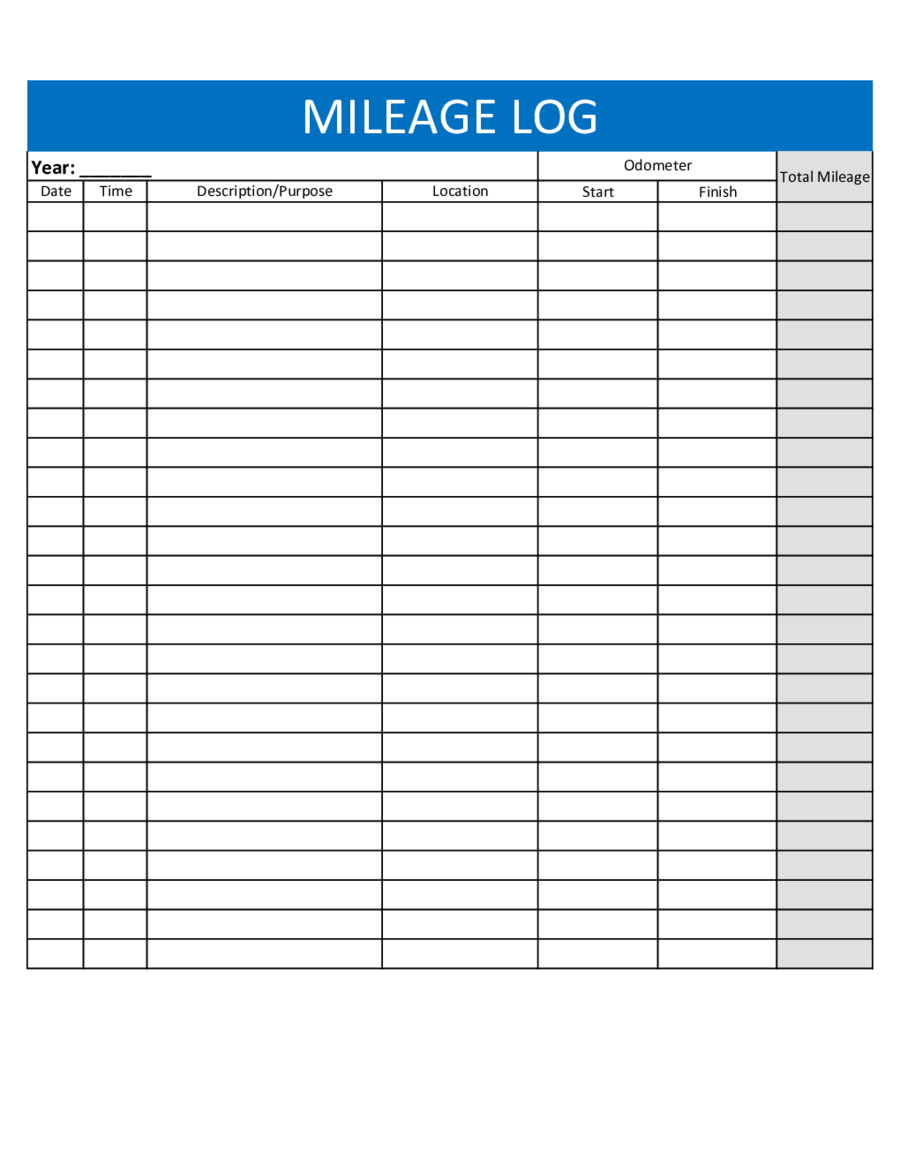

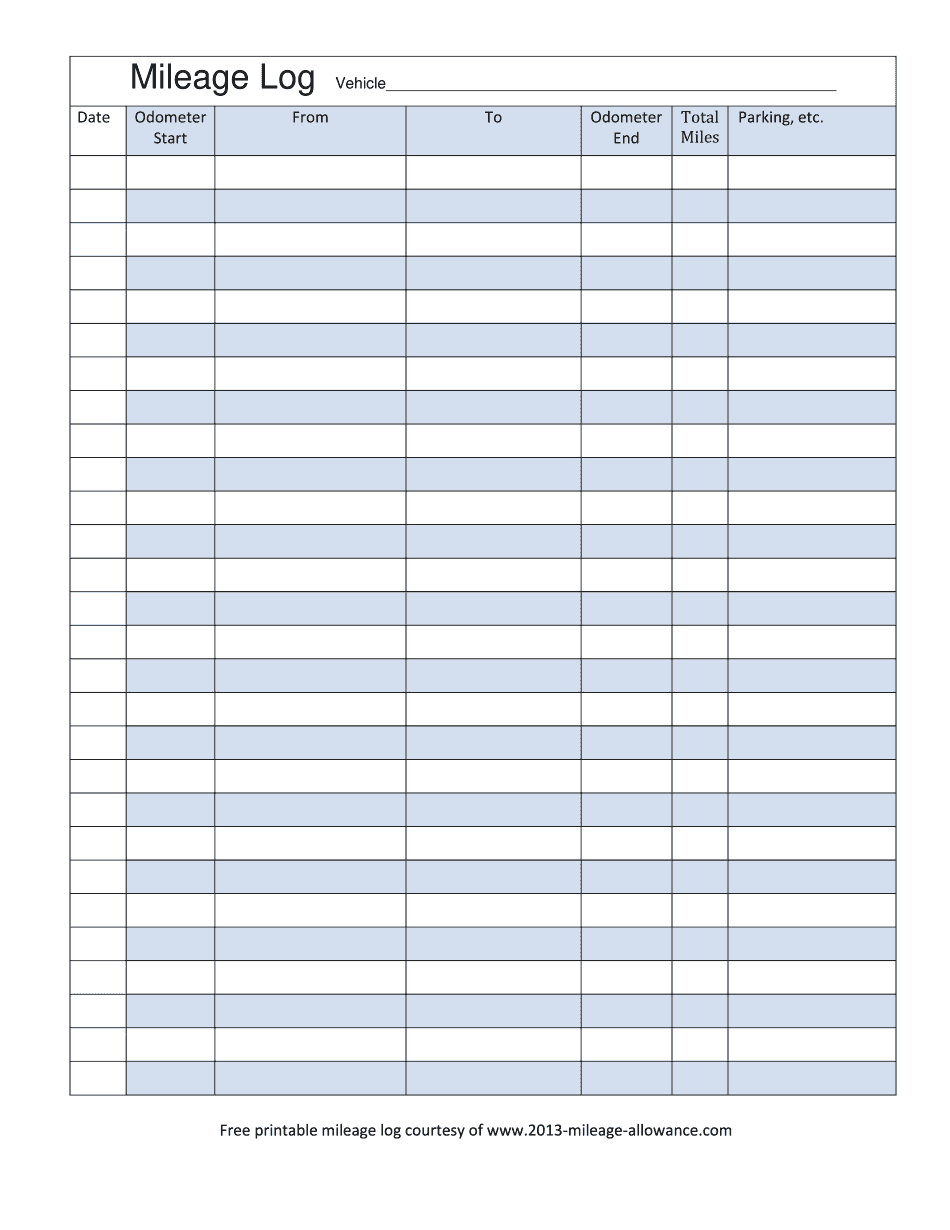

Mileage Reimbursement 2024 California Calculator Harri Klarika, What are the rules for mileage reimbursement in california? The california state university mileage rate for calendar year 2024 will be 67 cents per mile, which is an increase from the 2023 rate of 65.5 cents per mile.

Source: luraqnatassia.pages.dev

Source: luraqnatassia.pages.dev

California Mileage Rate 2024 Calculator Goldy Karissa, The university of california's mileage reimbursement rates for expenses incurred in connection with the business use of a private automobile increased in. The 2024 standard irs mileage rate for business miles is 67 cents per mile.

Source: soniaqcarline.pages.dev

Source: soniaqcarline.pages.dev

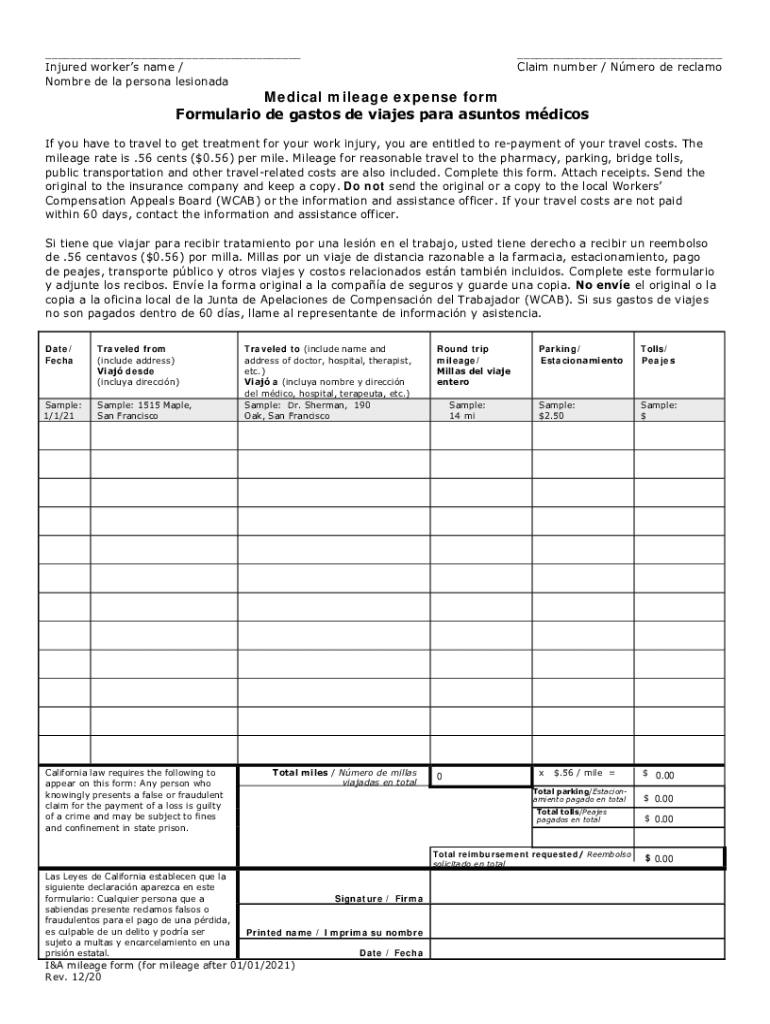

2024 Mileage Reimbursement Rate California Idalia Friederike, Having employees use their own vehicle for work can be expensive. Medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district.

Source: reneqaustina.pages.dev

Source: reneqaustina.pages.dev

Ca Mileage Reimbursement 2024 Calculator Talia Felicdad, 21 cents per mile driven for medical or moving. Beginning on january 1, 2024, the millage rate for reimbursement for business use will increase to 67 cents per mile.

Source: aileqmorganne.pages.dev

Source: aileqmorganne.pages.dev

Ca Mileage Reimbursement Rate 2024 Emmi Norine, Having employees use their own vehicle for work can be expensive. What is the california state law on.

Source: soniaqcarline.pages.dev

Source: soniaqcarline.pages.dev

2024 Mileage Reimbursement Rate California Idalia Friederike, Mileage rate in california 2023. What is the california state law on.

Source: lorraynewdorthy.pages.dev

Source: lorraynewdorthy.pages.dev

Mileage Reimbursement California 2024 Regan Charissa, Use this table to find the following information for federal employee travel: Since january 1st, 2024, the irs standard mileage rate has been.67 cents per mile.

Source: www.i-a-mileage-form.pdffiller.com

Source: www.i-a-mileage-form.pdffiller.com

20202024 CA I&A mileage Form El formulario se puede rellenar en línea, Use this table to find the following information for federal employee travel: The irs also announced its current mileage rate, which is 67 cents per mile for business purposes in the year 2024.

Source: jasminawletty.pages.dev

Source: jasminawletty.pages.dev

Gov Mileage 2024 Rena Valina, Medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district. Especially if they regularly drive long distances and spend money on fuel.

Source: ottiliewrosie.pages.dev

Source: ottiliewrosie.pages.dev

2024 Per Diem Rate San Diego Ca Billye Eleanore, Such rates are subject to open market rates quoted at time of actual car rental. The state of new york is exempt from the contracted base rates.

The 2024 Irs Mileage Rate Is As Follows:

When determining how to reimburse an employee for use of their personal vehicle, employers may select between different methods for reimbursement including.

67 Cents Per Mile Driven For Business Use, Up 1.5 Cents From 2023.

What is the california mileage reimbursement rate for 2023?

Category: 2024