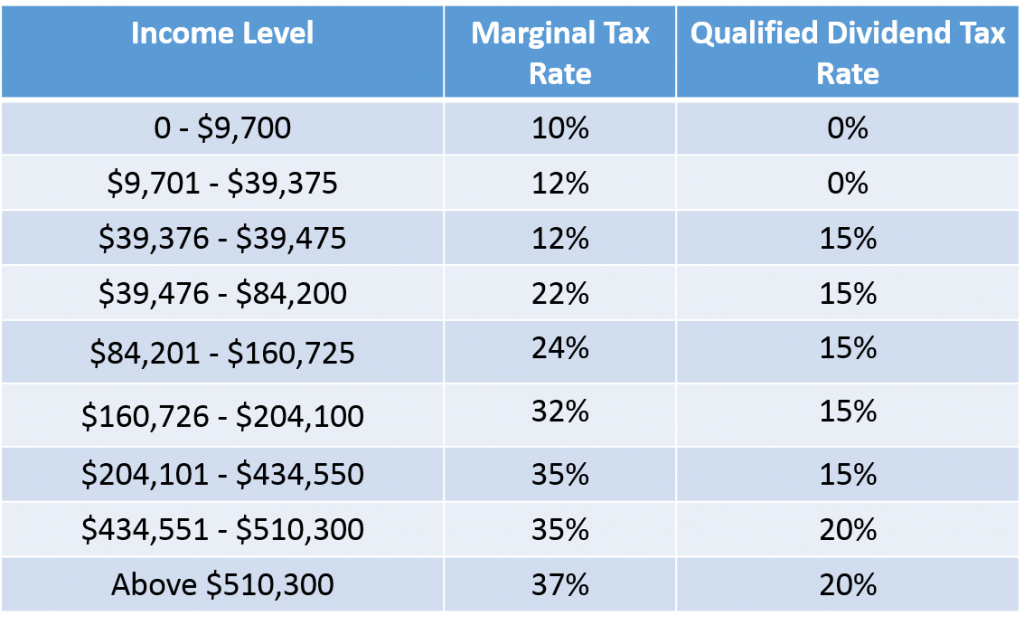

Tax Rate Qualified Dividends 2024. Higher tax brackets will pay 15% or 20%. The qualified dividend tax rate for tax year 2022 — filing in 2023 — is either 0%, 15% or 20%.

Qualified dividends x capital gains tax rate. Rates again vary from 0% up to 20%,.

The Qualified Dividend Tax Rate Increases To 20% If Your Taxable Income Exceeds $276,925 (If Married Filing Separately), $492,300 (If Single), $523,050 (If Head Household) Or.

Individuals who earn $200,000 or.

Ordinary Dividends Are Taxed At Income Tax.

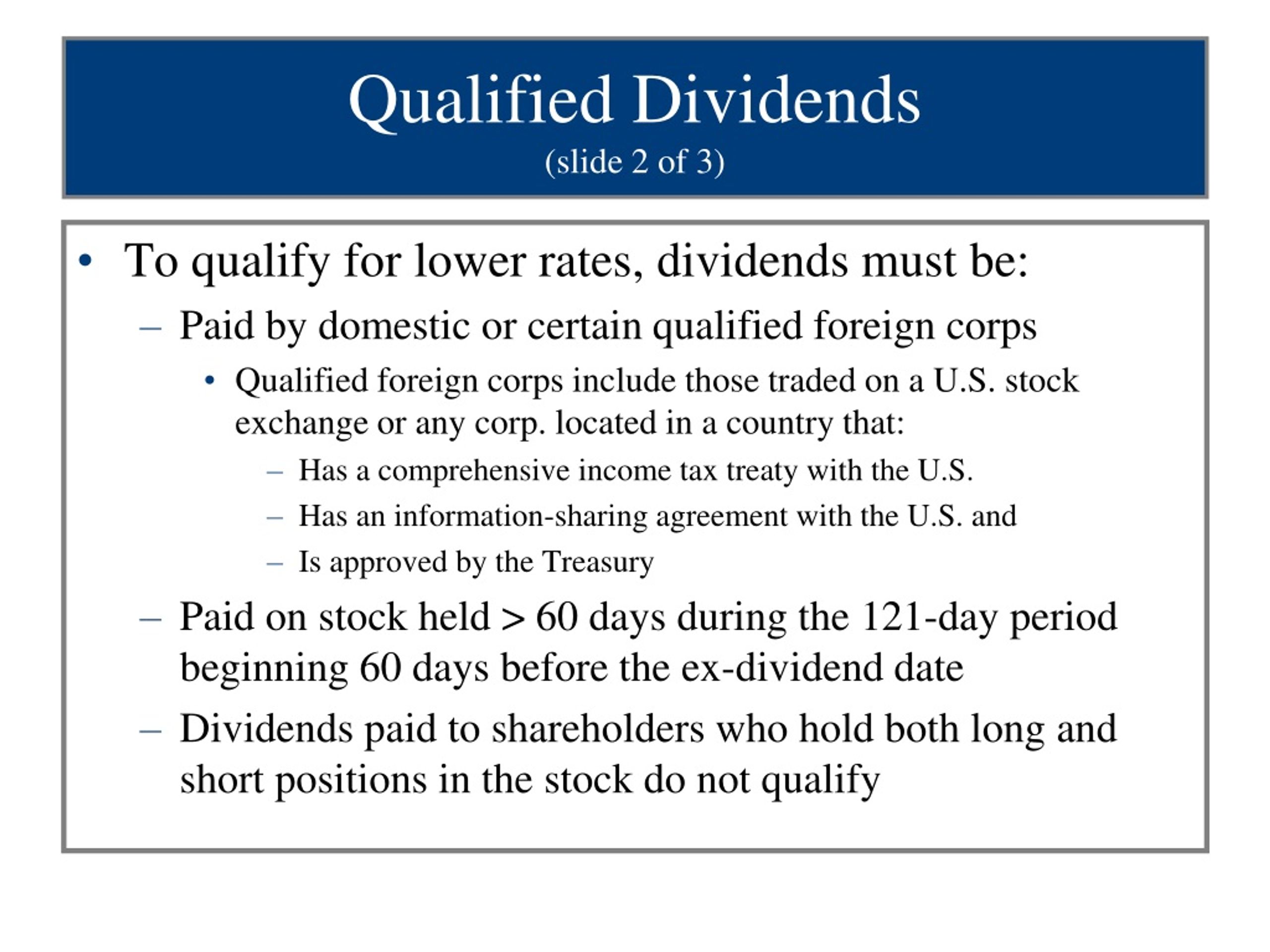

28, 2023, updating the list of countries with a tax treaty with the united states that meet the qualified dividend.

In The Year 2021, The Company.

Images References :

Source: jemimaqmatelda.pages.dev

Source: jemimaqmatelda.pages.dev

Irs Tax Brackets 2024 Vs 2024 Annis Hedvige, The exact dividend tax rate depends on what kind of dividends you have: Because the 2024 income tax brackets indexed higher, dividend tax brackets climbed, too.

Source: findwes.com

Source: findwes.com

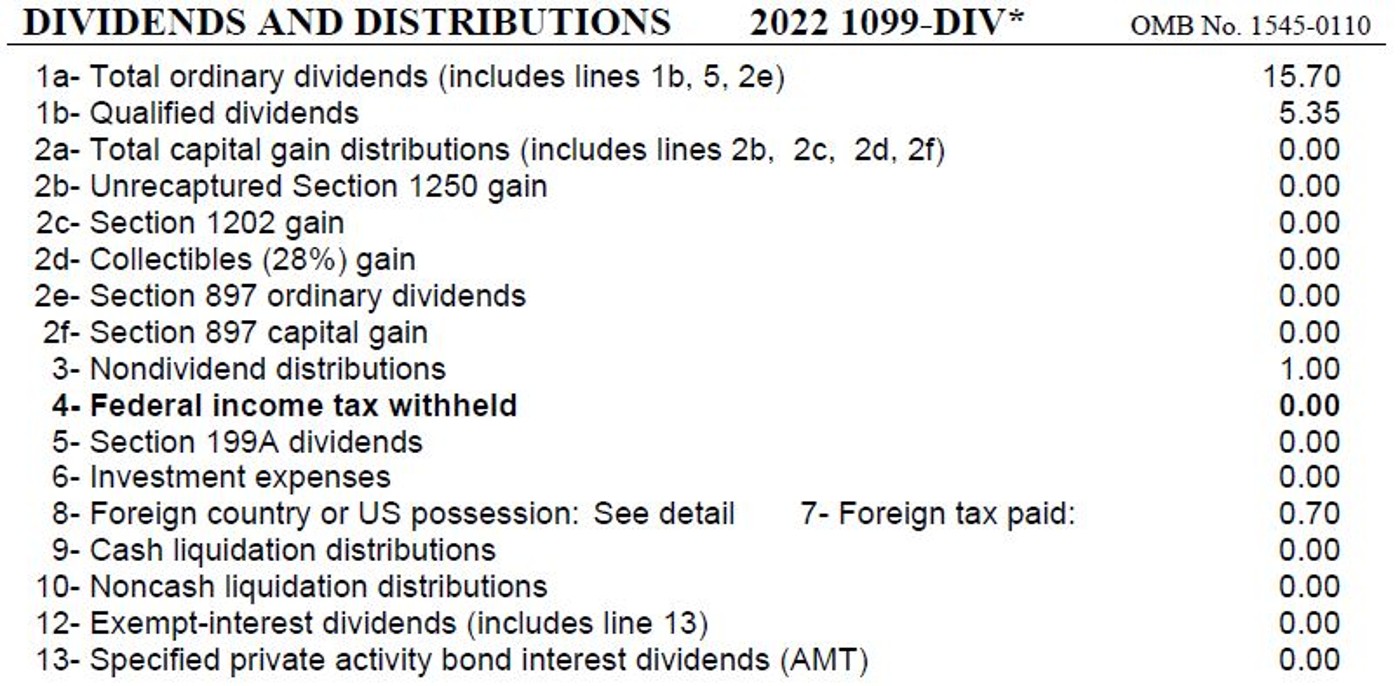

Tax Basics WES, The qualified dividend tax rate for tax year 2022 — filing in 2023 — is either 0%, 15% or 20%. Qualified dividends get taxed at favorable rates, while nonqualified or ordinary dividends are taxed at your ordinary (marginal).

Source: www.marketbeat.com

Source: www.marketbeat.com

Dividend Tax Calculator Understanding Dividend Tax Rates, The exact dividend tax rate depends on what kind of dividends you have: The qualified dividend tax rate for tax year 2023 — filing in 2024 — is either 0%, 15% or 20%.

Source: gersgiasbwa.blogspot.com

Source: gersgiasbwa.blogspot.com

40 qualified dividends and capital gain tax worksheet Worksheet Master, The maximum tax rate for qualified dividends is 20%, with a few exceptions for real estate, art, or small business stock. Individuals who earn $200,000 or.

Source: www.moneysense.ca

Source: www.moneysense.ca

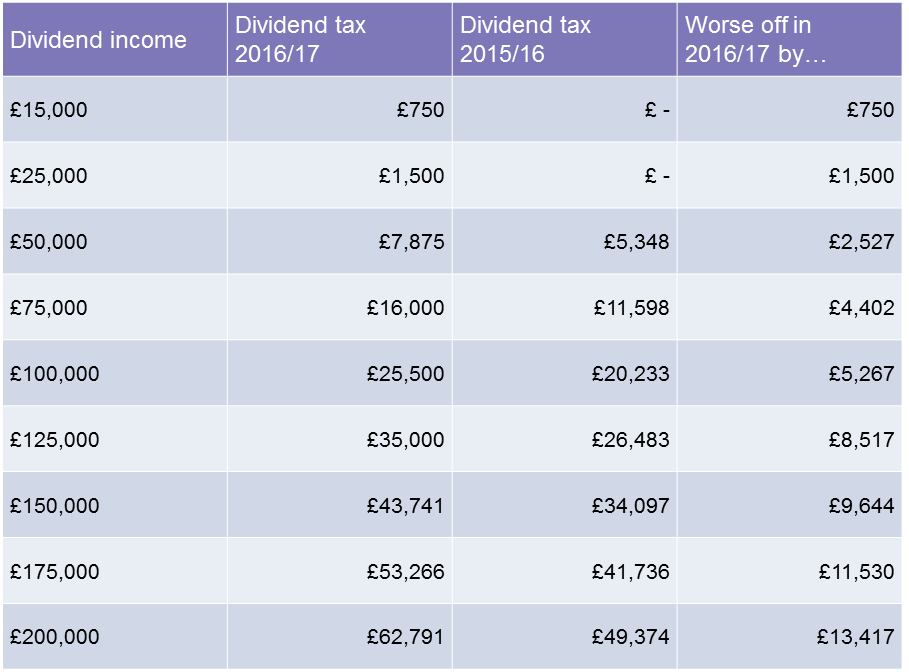

How much you'll save with the dividend tax credit, When your other taxable income (after deductions) plus your qualified. The dividend is an income that you receive if you.

Source: fity.club

Source: fity.club

Eligible Dividends, Do you need to pay tax on dividend. In may 2023, the company issued a dividend of rs 11.3 (1,130%).

Source: tickertape.tdameritrade.com

Source: tickertape.tdameritrade.com

What Are Qualified Dividends and Ordinary Dividends? Ticker Tape, 25 apr, 2024 12:48 pm. Qualified dividends get taxed at favorable rates, while nonqualified or ordinary dividends are taxed at your ordinary (marginal).

Source: www.wellersaccountants.co.uk

Source: www.wellersaccountants.co.uk

Beware! Your dividend tax rate is changing, here's what you need to know, Do you need to pay tax on dividend. Additionally, the company's provision for income taxes decreased $4.8 million in the first quarter of 2024 due to a lower effective tax rate, partially offset by higher.

Source: www.businessinsider.nl

Source: www.businessinsider.nl

Understanding what qualified dividends are why they're taxed at lower rates, The tax schedule for qualified dividends features only three levels: 28, 2023, updating the list of countries with a tax treaty with the united states that meet the qualified dividend.

Source: classdbdaecher.z13.web.core.windows.net

Source: classdbdaecher.z13.web.core.windows.net

2021 Form 1040 Qualified Dividends And Capital Gain Tax Work, The maximum tax rate for qualified dividends is 20%, with a few exceptions for real estate, art, or small business stock. As a taxpayer, you may be unsure about how to treat dividend income while filing your tax return.

Qualified Dividends X Capital Gains Tax Rate.

The treasury estimates that white families are the recipients of 92% of the benefits of preferential rates on capital gains and qualified dividends, compared to 2%.

Earning Dividends Is A Valuable Source Of Income For Investors, Particularly Those Saving For Retirement.

Rates again vary from 0% up to 20%,.